Entrepreneurs who want to turn their woodworking talents into a business must engage in careful financial planning to set their new venture up for success. Custom furniture builders, cabinet makers, wood craft artists, and all types of specialty woodworking studios need to thoroughly assess initial startup funding requirements, put systems in place to maintain positive cash flow month-to-month, and implement budgeting and tracking practices that optimize profits as operations grow. Getting clarity on startup costs, funding options beyond one’s personal savings, ongoing cash management strategies, proper recordkeeping, smart budgeting tips, and long-term best practices to sustain profitability enables putting each woodworking operation on the soundest financial footing from launch onwards.

Estimating Startup Costs

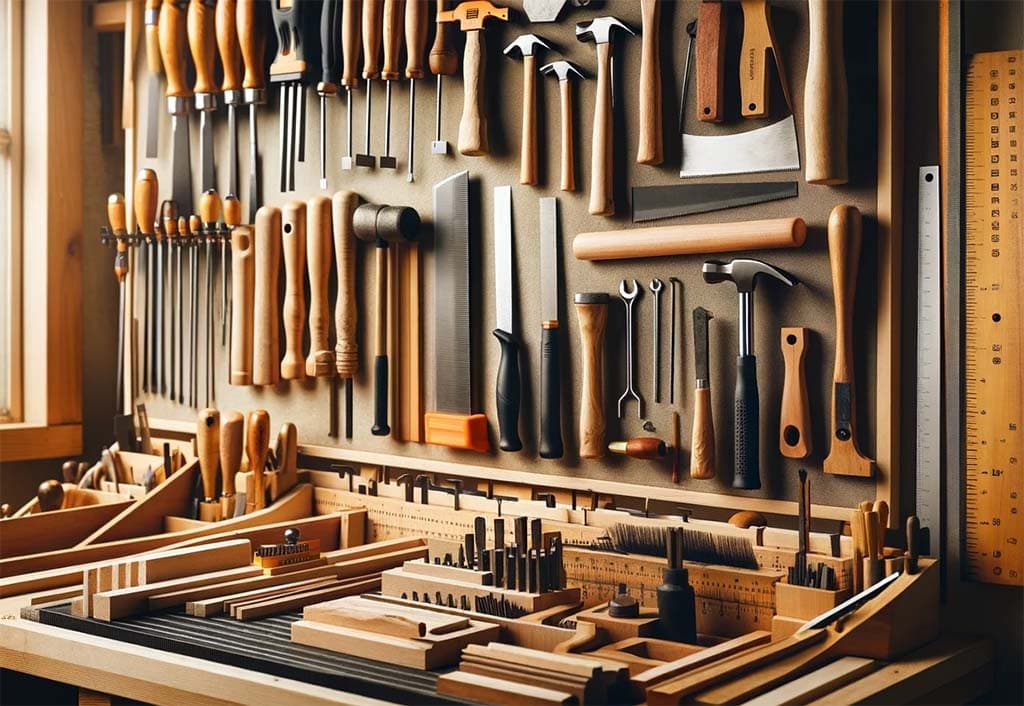

Typical startup costs run the gamut from essential woodworking tools and shop equipment, to shop leasing and related utility fees, to licensing, insurance, raw materials inventory, marketing promotions for launch, professional services like legal and accounting setup fees, and basic operating costs to sustain the business for at least the first 3-6 months without sales revenue. Other potential startup costs may include a cargo vehicle for materials transport, custom branding and packaging for products, a base supply of hardware and supplies, office technology needs, and improvements or modifications to leased workshop spaces. Underestimating startup funding requirements can paralyze or completely halt progress toward getting a woodworking business off the ground. Therefore, seasoned entrepreneurs recommend new ventures overestimate by 20-30% initially to allow room for unexpected early expenses as operations commence.

Funding Your New Venture

Once reliable estimates are set for launch outlays, woodworking startups need to explore capital financing options – first determining how much they can allocate from their own savings or available funds before seeking external sources. After personal contributions max out, the next level of startup financing encompasses small business loans and similar options that provide necessary remaining capital in exchange for fixed repayments with interest. Typical funding avenues beyond personal savings include small business administration (SBA) backed loans, traditional small business bank loans, equipment-specific financing loans, business lines of credit, and credit cards or family loans that offer zero percent introductory annual percentage rates – allowing modest startup purchases to be repaid gradually over 12-18 months without accumulating excess interest fees. Within these financing products, terms and rates can vary widely so woodworking entrepreneurs must carefully evaluate what matches their business goals best. Woodworking startups can also explore personal loan options with Lending Club to finance startup costs. See our related article about applying for Lending Club personal loan here.

Managing Cash Flow

Once enough startup funding is secured and initial outlays transact to open for business, meticulous cash flow management emerges as the next vital financial priority for woodworking startups. The first year or two almost never yield high net profits – so business stability hinges on maintaining healthy gross margins on sales while keeping expenses low. Savvy wood shop owners set sales pricing strategically to achieve gross profit margin goals after subtracting all material and labor costs. They refrain from purchasing materials until client payments for commissioned work are received in full, allowing very little outstanding accounts receivable. Careful cashvisors quickly invoice completed work and follow up politely but firmly on any late customer payments, keeping income flowing reliably into the business each month. During slower sales periods, they seek deposits or prepayments wherever possible to keep tool purchases and inventory orders timed well, and they temporarily trim unnecessary operating expenses if reserves run too low pre-sale.

Budgeting Tips and Strategies

With estimated startup funding secured, ongoing cash flow and recordkeeping systems established, woodworking businesses must implement cash management in the form of a detailed operating budget – continuously tracking projected income and expenses against actual ongoing figures. Best practices dictate crafting budgets that completely separate all business revenue and costs from personal finances, include very modest owner salary pullouts only after other operating expenses are covered, and delineate financial model projections for both baseline and ideal income scenarios based on volume. Projections should be revisited frequently when first starting out as new wood ventures often experience fits and starts in sales activity and periods of devoting more or less time to active selling depending on Workflow. Carefully built budgets account for seasonal fluctuations and working capital needs during slower months to avoid cash flow surprises.

Securing Investments and Loans

Once a woodworking enterprise establishes regular initial customer sales and plans for viable expansion arise, studio owners have options to fund growth plans through business partner investments or loans. Taking on financial partners or outside private investors provides necessary capital infusions in exchange for partial company ownership interest. Bank loans backed by good business credit and financial reporting history cultivated in the first year remove the need to forfeit control. Before acquiring any financing, wood shop owners should meet with qualified banking professionals such as an SBA representative to discuss specific plans for the capital. They can outline what size loan or investment amount matches expansion goals for equipment upgrades, added retail space, additional skilled labor, more extensive inventory, or improved eCommerce capabilities over the next two years.

Achieving Long-Term Profitability

Over three to five years, with consistent quality craftsmanship and gradual expansion of customer networks served, passionate woodworking enterprises position themselves to generate very healthy net annual profits through various optimizations. Specializing in a specific niche medium like custom cabinetry or hand carved furnishings allows streamlining efficiency of design plans and material sourcing once repeat business is established. Creating higher price point signature custom work raises margins substantially for dedicated clients. Investing further in high production equipment, smarter digital workshop tools, and near term apprentice training elevates output potential per man hour. Streamlining shop layout and inventory management saves costs previously lost to wasted materials or labor slowdowns.

Conclusion

In closing, with abundant passion and carpentry skills in supply, woodworking entrepreneurs destined for success set their sights equally on mastering the financial planning and cash flow management basics from the eager start. Costs get thoroughly defined, funding secured in advance, and budgets designed that allow flexibility as operations build, until profit thresholds hit their stride. Meticulous tracking and analysis of all income streams and expenses – while continuously fine-tuning pricing and workflows to optimize efficiency – liberates studios from a relentless scramble to merely stay afloat. Savvy planning grants wood shop owners the runway needed to transform hobbyist talent into specialized enterprises as unique as the hand-made products they craft.